OPINION:

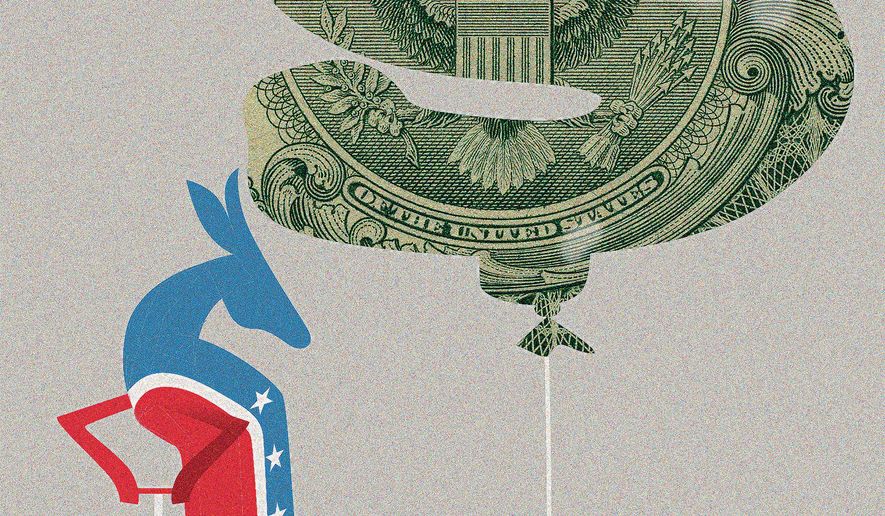

California’s millionaires and billionaires need to evacuate before it’s too late. The state’s tax-happy politicians are salivating over the prospect that they may soon be able to spend billions of dollars in expropriated wealth.

That could happen in November if residents approve an initiative that confiscates 5% of the property belonging to people with “excessive accumulations of wealth.” The Golden State aristocracy can’t even wait to see how the measure fares at the ballot box before making their escape because the greedy cash grab is retroactive.

Silicon Valley icons such as Google founders Sergey Brin and Larry Page are said to be furiously shoving hundreds of millions of dollars in assets into saner jurisdictions. Despite their company’s solidarity with left-wing causes, they reject the warm embrace of collectivism when it comes for them.

California is golden no more. Texas, Tennessee and Florida have become the hot real estate markets for plutocrats on the lam. That’s California’s loss. If the state’s voters want to seize the property of their own people so it can be redistributed to illegal aliens and welfare scammers, that’s also their business.

When internal economic madness spills beyond its borders, it becomes a national problem. Fortunately, the Supreme Court is expected to decide by month’s end whether it will hear Florida v. Franchise Tax Board of California, a case that just might curb extraterritorial taxation schemes.

Florida Gov. Ron DeSantis, a Republican, is challenging California’s “special” state tax code rule that dispatches Sacramento’s tax man to collect money that non-California businesses earned from selling goods and services outside California.

Clever government accountants in the land of fruits and nuts realized they would have more loot to spend if they fiddled with the formula states rely on to divvy up tax liability for companies that operate across state lines.

Traditionally, if a Miami-based company reports a $10 million profit, but $1 million of that amount came from operations in Los Angeles, then Sacramento would be entitled to its cut of only $1 million. Using the new math favored by Gov. Gavin Newsom’s team, California hopes to grab many times more than its share, say, $5 million.

Florida says that’s not just unfair but is also an outright violation of the Constitution’s commerce, import-export and due process clauses. The only thing leaders in Tallahassee can do about another state fleecing their citizens is to bring their complaint to the high court. So, they have.

Mr. DeSantis carefully trimmed tax and regulatory levels to attract business and job creators to the Sunshine State, but his designs crumble if Mr. Newsom can pick the pockets of enterprises in Palm Beach. High court justices need to settle this dispute before other blue states get the wrong idea, especially profligate jurisdictions such as New York, Illinois and Massachusetts, which also suffer from net out-migration.

Letting this precedent stand would encourage liberal governors to follow Mr. Newsom’s lead. Blue states would export their taxes and siphon resources from hardworking men and women living in states such as Texas, Utah and Florida, where sensible, pro-growth, job-creating policies are the norm.

One-party rule in California created a fiscal mess, but Floridians aren’t responsible for fixing it. Democrats own that fiasco, and they shouldn’t be allowed to offload their obligations on the rest of the country. If California gets away with this swindle, then the “special rule” will be just the beginning.

Justices need to accept this case.

Please read our comment policy before commenting.