OPINION:

The late Sen. Warren Magnuson of Washington state, who served more than 30 years in Congress, was the inventor of the phrase “a fair advantage.” Wilt Chamberlain had a fair advantage on the basketball court because he stood 7 feet tall. It allowed him to score 100 points in a single game.

The Trump 2.0 tax bill, now moving through Congress, should establish a fair advantage for U.S. companies.

Of course, tariffs are President Trump’s retaliatory stick to stop foreign countries from discriminating against goods and services made in America. The taxes and tariffs charged in Europe and Asia, especially China, punish everything, including our dairy, wheat, pharmaceutical and digital tech producers.

However, Mr. Trump wants an additional carrot approach to increase domestic production from Maine to Michigan to Montana. He wants Congress to pass a 15% corporate tax rate, down from the current 21% rate.

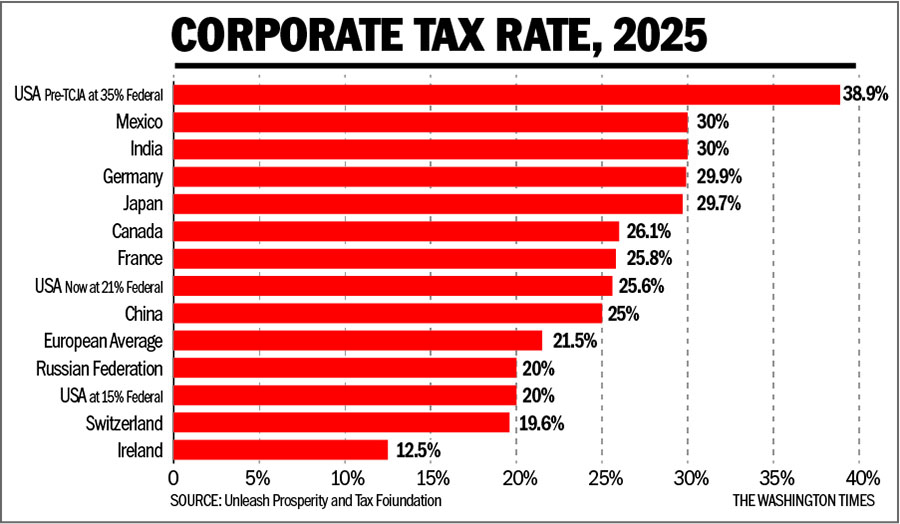

That’s a real sweetener. Starting next year, the U.S. would slide down the tax scale from having the highest corporate tax burden (35%) as recently as 2017 to having close to the lowest in the world.

This would suck capital investment back to America in a nanosecond and financially seduce companies to reshore factories, labs and headquarters in the U.S. with bargain-low tax rates. When Ireland cut its tax rate to the lowest among industrialized nations, to 12.5%, it became the fastest-growing nation in Europe, and its tax receipts soared.

The 15% business tax rate can be easily “paid for” with the higher tariff revenues collected from the 10% tax tariff that now applies to all nations and the higher duties on nations that won’t negotiate.

The Trump grand vision is to create a level taxation playing field by imposing higher tax rates on products made in places like Beijing and then lowering taxes on things made in Baltimore. Because other nations impose value-added import taxes and tariffs of up to 25% on products with the “Made in America” label, the 15% corporate tax here at home makes perfect sense as a counterpunch. This isn’t protectionism — I believe fervently in the benefits of international trade — but simply a shrewd and GATT-legal strategic move to put American companies and workers first.

From my first meeting with Mr. Trump in January 2016, when he began his run for president, to the present day, he has always emphasized the 15% tax rate for all businesses.

Recently, he has been telling Congress that if it won’t lower the corporate tax rate to 15% for all American companies, then it should offer this lower rate on business profits of companies whose products are predominantly made and manufactured in the U.S. This could easily be paid for with Mr. Trump’s new across-the-board tariff.

There’s a lot of dim-witted chatter in Washington about raising tax rates so that the rich pay their “fair share.” That would only handicap our business owners and benefit our competitors.

By contrast, the Trump 15% corporate tax rate would give American companies and workers a major leg up in international markets. Studies by economists at the American Enterprise Institute find that this “fair advantage” tax policy would lead to higher wages for American workers and higher share prices for American shareholders and retirees. That’s a good way to put America first.

• Stephen Moore is a visiting senior fellow at The Heritage Foundation and a co-founder of Unleash Prosperity. He has served as a senior economic adviser for President Trump.

Please read our comment policy before commenting.