OPINION:

Does anyone remember back in 2008 when the housing market collapsed and the stock market crashed, with many tens of millions of Americans seeing their lifetime savings nearly wiped out?

Apparently, Washington’s politicians are suffering from amnesia, even though the crash was the worst since the Great Depression.

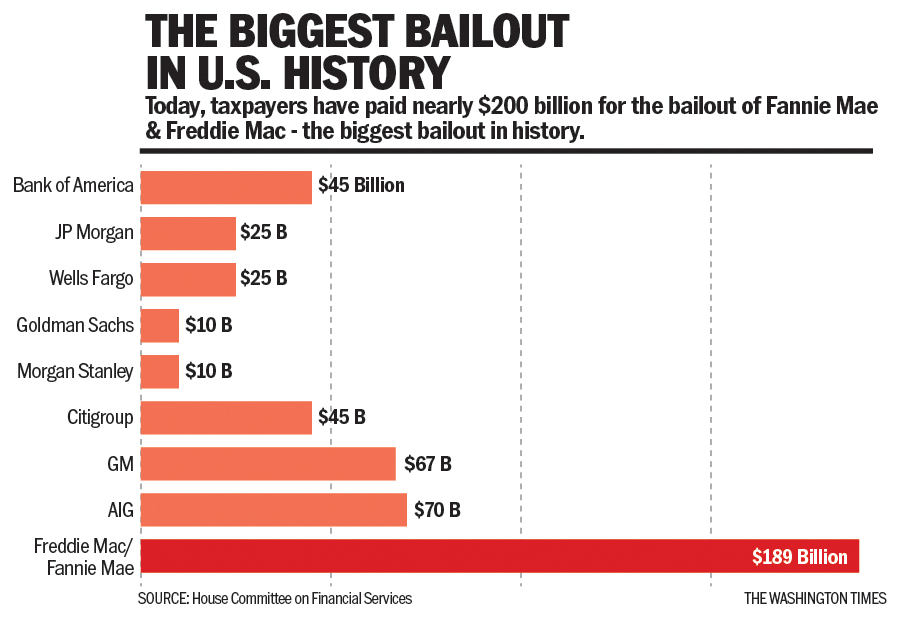

What else has been conveniently forgotten inside the swamp is that the institution that lost the most money and required the biggest taxpayer bailout wasn’t any of the major banks that teetered on the verge of bankruptcy, but Fannie Mae, the government-guaranteed enterprise that ensures federal mortgages and was supposed to never fail. Fannie received nearly $200 billion of taxpayer rescue funds.

Fannie Mae, which now resides in one of the glitziest near 1-million-square-foot high-rise office buildings in the Washington area, is still in conservatorship. Hopefully, the Trump administration will move toward setting it free and severing all its federal strings.

Instead, Fannie and the housing lobby want to expand their power by forcing taxpayers to take on tens of billions of dollars of new risk by effectively eliminating title insurance on federally backed loans and replacing it with … ta da: Fannie Mae as the de facto insurance provider on hundreds of billions of dollars of homes. What could possibly go wrong?

Title insurance ensures that when you pay $100,000 or $1 million for a new home, you are not the victim of a fraudster and that you have rightful ownership. Private title insurance typically costs a one-time fee of 0.5% to 1% of the purchase price, which is hardly price gouging.

In the last months of the Biden administration, Fannie Mae proposed a federal takeover scheme to lower the price of buying a home. It should have received a ceremonial burial when Vice President Kamala Harris lost the 2024 election, but Fannie and the housing lobby are powerful and relentless. They say it won’t cost the taxpayer a dime.

Uh huh. This is what Fannie and the Federal Housing Administration said when they facilitated low down payment loans in the early 2000s, which enticed Americans into homes they couldn’t afford. Shortly before the 2008 crash, Fannie was even touting studies that concluded the possibility that Fannie would go bankrupt was one in a million. Whoops!

Make no mistake: This Fannie Mae scheme is privatization in reverse. It will drive a well-functioning private insurance market out of business and replace it with government-subsidized insurance coverage.

This would greatly expand Fannie Mae’s charter and intrude on the traditional state oversight that ensures the industry’s safety and soundness. The Trump administration is about returning power to the states, not seizing power.

Congress and the Trump administration, with oversight of federal housing policy, should end this sham. Fannie Mae has already taken taxpayers to the cleaners, and to quote the rock band The Who: We won’t be fooled again.

• Stephen Moore is a senior fellow at The Heritage Foundation and a co-founder of Unleash Prosperity. He is co-author of the book: “The Trump Economic Miracle.”

Please read our comment policy before commenting.