Investors looking to buy their way into a pathway to citizenship in the U.S. will have to pony up far more money in the future, under a new regulation Homeland Security posted Tuesday.

The standard investment will now be $1.8 million, up from $1 million, and the discount rate for people who invest in economically troubled areas will be $900,000, up from $500,000 under the old rules.

U.S. Citizenship and Immigration Services also said it’s tightening rules to prevent people from abusing the definition of economically troubled areas.

The changes are to what’s known as the EB-5 visa, which rewards people willing to invest their money in the U.S. with green cards. They must meet an investment minimum and show their money is responsible for creating or sustaining jobs.

The program has been rife with reports of fraud, and the investment amounts have not kept up with inflation.

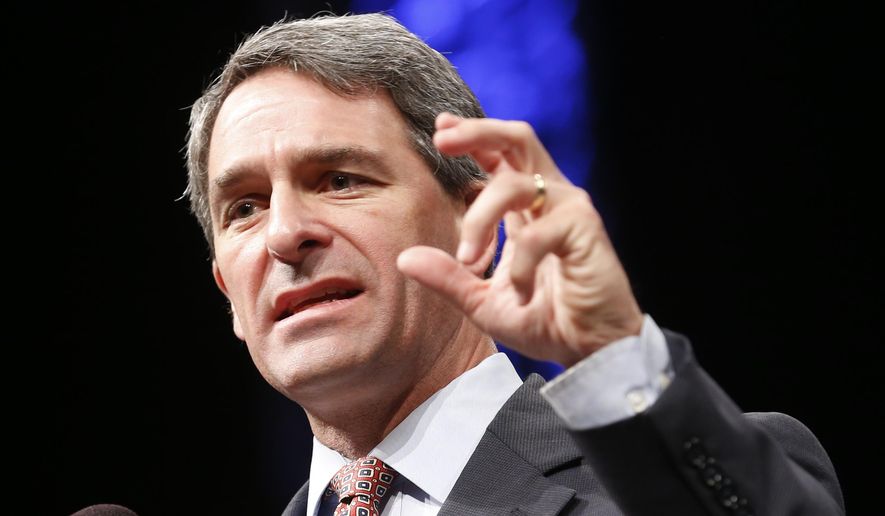

Acting USCIS Director Ken Cuccinelli said Monday the program had “drifted” away from its original goals. The new rules, he said, will restore the direction Congress intended.

“Our reforms increase the investment level to account for inflation over the past three decades and substantially restrict the possibility of gerrymandering to ensure that the reduced investment amount is reserved for rural and high-unemployment areas most in need,” he said.

Many countries have what’s known in the wealthy migrant community as a “golden visa,” or a chance to earn residency by investing in that nation.

The $500,000 minimum investment for the U.S. has been at the low end of the scale.

France’s program, for example, required a 10 million Euro investment that would create or save at least 50 jobs.

Spain asked for a 1 million Euro deposit in a Spanish bank or investment in a company, or else a purchase of 2 million Euro of Spanish public debt.

The U.K., meanwhile, asked for a 2 million pound investment to gain temporary residence. The British program, which had become particularly sought-after by wealthy Russians and Chinese, came under fire over corruption allegations last year.

In the U.S., the EB-5 program has become a significant source of funding for real estate development projects — and has produced some high-profile instances of fraud, including ski resorts in Vermont that regulators described as Ponzi schemes.

The Government Accountability Office and the Securities and Exchange Commission have both been active in warning of fraud.

The EB-5 program regularly comes up for review in Congress, and some key critics, including Sen. Chuck Grassley, the most senior Republican in the Senate, had tried to force changes. His efforts met with resistance.

Mr. Grassley on Tuesday praised President Trump and USCIS for making progress where Congress had failed.

“By implementing these EB-5 rules, he is keeping his word to drain the swamp and bring new opportunities to rural America as well as communities in need,” Mr. Grassley said. “This rule not only brings more integrity to our immigration system, it also brings new jobs to America.”

• Stephen Dinan can be reached at sdinan@washingtontimes.com.

Please read our comment policy before commenting.